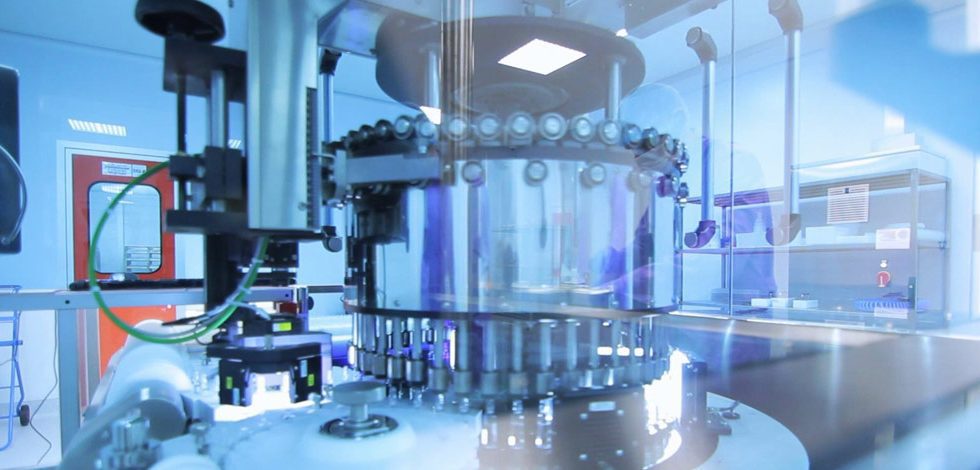

R&D tax incentives reward businesses in all sectors for their innovation, and the life sciences, pharmaceutical and biotech sectors are no exception. These industries often face unique technical challenges that require significant investment in R&D to overcome.

If you’re a business in the life sciences sector and you’re undertaking projects to find solutions to technical challenges, you may be eligible for R&D tax relief.

Life Sciences experts who really understand your business

Our specialist Life Sciences team are more than just tax and accounting professionals. Many have worked in the life sciences sector, meaning we can understand your business and how you work.

The process of determining eligibility and maximising an R&D tax claim can be complex, but with the help of Ayming’s Life Sciences experts, it can be made simple.

We make sure that we have peer-to-peer conversations with your team to accurately identify all eligible expenditure, ultimately maximising your R&D tax claims.

What counts as research and development in Life Sciences, Pharma and Biotech?

Here are some examples of projects that we’ve successfully claimed for on behalf of our clients. If these look familiar, then your business might also qualify.

Projects that qualify for R&D tax relief include:

- Development of new applications for existing drugs or devices.

- Establishing new manufacturing processes where technology is employed or new manufacturing techniques are used.

- Development or improvement of experimental assays/protocols and disease models.

- Designing and developing certain hardware and software systems for use in research and clinical development.

- Biological screening and pharmacological testing.

- Development of new or improved pharmaceuticals, biopharmaceuticals or medical devices.

- Development of reagents, devices and equipment for testing drugs or patient samples.

- Toxicology and safety testing.

- Design of protocols for clinical trials phases I-III, potentially phase IV.

- Development of new methods/formulations for drug delivery or improvement of existing ones.

Why choose Ayming?

Our R&D specialists can:

- Increase your claim value

- Streamline your processes significantly

- Make sure your claims are robust and low-risk

With over 15,000 R&D projects analysed every year, we’ll do all the heavy lifting and make sure your claims are fully optimised as well as safeguarded against HMRC enquiries.