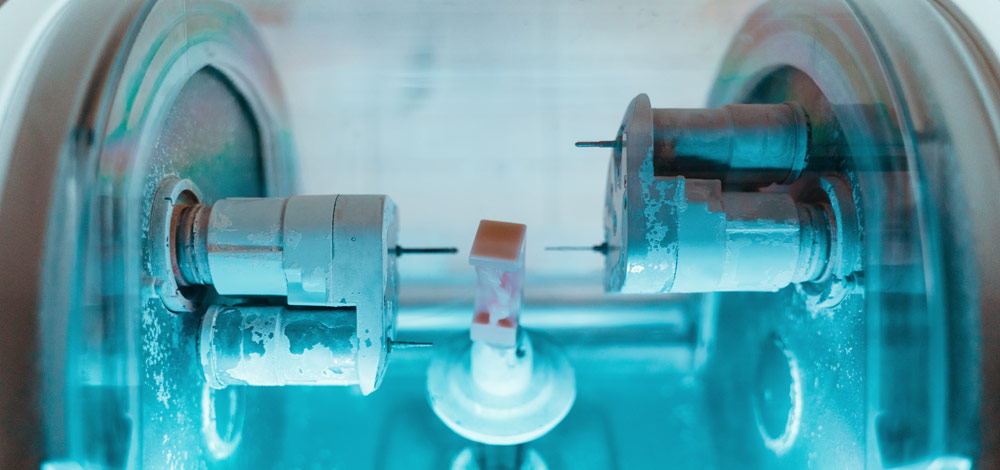

Tax rules on claiming relief for research and development (R&D) are being tightened. However, the reforms include exceptions designed to avoid penalising genuine innovation, especially by biotech companies.

The restrictions may potentially impact every sector of the economy, affecting two main areas of expenditure: subcontractor costs and spending outside the UK. New territoriality restrictions will be introduced from April 2023 and will refocus R&D tax credits on investment and innovation in the UK. But, notably, the Government has granted some important exemptions, including special recognition for Life Sciences companies running clinical trials overseas.

Significant additions will also reflect the growing importance of data processing and the role of clinical drug trials conducted outside the UK. Companies will still be able to claim tax relief on the costs of software sourced from overseas and payments made for clinical trial volunteers in other countries. In addition to this, from April 2023 onwards, companies will be able to include relevant data and cloud computing costs.

Reassurance for Life Sciences sector

There was widespread concern after the surprise announcement of the territoriality restrictions in the October 2021 Budget. These exemptions should reassure many companies, particularly those in the UK’s Life Sciences sector that rely on foreign clinical trials. Conducting this work overseas can be essential for R&D, not least when seeking licensing approvals for new medications and vaccines.

Remember that costs on R&D activities taking place overseas incurred before April 2023 by UK companies may still be eligible for full tax relief. Also, we will not know the full impact of the changes until the draft legislation is published later this year following consultation on the Treasury’s R&D Tax Reliefs Report, released at the end of 2021.

Subcontractor costs are the other area where the taxman is tightening up. A PAYE cap is now in force under the R&D tax credit regime for SMEs (small and medium-sized enterprises). The PAYE cap rules restrict the R&D tax relief claim for SMEs. This measure limits the amount of payable R&D tax credit that an SME can claim to £20,000 plus 300% of its total Pay as you Earn (PAYE) and National Insurance Contributions (NICs) liability for the period.

Cushioning the impact on genuine R&D work

Again, there are targeted exemptions that will cushion the impact on genuine R&D work, and these should leave most biotech businesses unscathed:

- The first exemption is a de minimis threshold for small claims. The cap will not affect a claim for payable credit below £20,000.

- When calculating the cap, claimants can include the PAYE and NIC liabilities of related parties where these costs are attributable to the R&D project. Also, they are subject to the 300% multiplier.

- Any claim, irrespective of its size, will be uncapped if it meets two tests on:

-

- Intellectual property: The company’s employees are creating, preparing to create, or actively managing IP; and

- Outsourced activity: The expenditure on work subcontracted to an external party or its workers is less than 15% of the overall R&D expenditure.

The PAYE cap applies to accounting periods beginning on or after April 1, 2021.

As with the territoriality restrictions, the new rules are far less stringent than initially feared when first announced in the 2018 Budget.

Further reforms to the UK’s wide-ranging tax credits scheme for R&D can be expected from HM Treasury’s ongoing review as it seeks to clamp down on potential abuses. However, the UK government remains committed to encouraging genuine innovation by national businesses and to growing the contribution of the Life Sciences industry to UK PLC.

No Comments