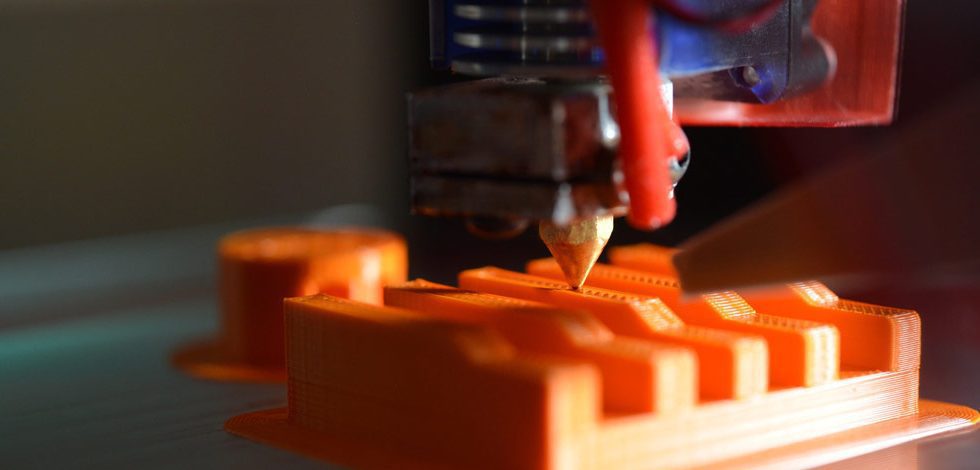

With the advent of Industry 4.0 (the fourth industrial revolution), the manufacturing sector is going through a significant transformation, making technological development a daily challenge.

However, resolving many of those technical challenges qualify as manufacturing industry research and development and therefore may make you eligible for R&D tax relief.

Manufacturing experts who really understand your business

Here at Ayming, we’re more than just tax and accounting professionals. Many members of our specialist team have worked within the manufacturing industry themselves, meaning they can truly understand your business in order to identify all eligible expenditure for you R&D tax claims.

Galahad Clark, Managing Director and Founder, Vivobarefoot

What counts as research and development in the manufacturing industry?

If your business is involved with any of the following areas and you’re not already claiming R&D tax relief, then it’s likely that you could be.

Manufacturing industry research and development:

- Design and development of new machine prototypes offering functionalities that are not easy to achieve.

- Significant reduction of waste through process and machinery innovation.

- Integration of complex manufacturing processes into one fully automated process.

- Reduction in weight or environmental impact through alternative materials or manufacturing processes.

- Study of materials to develop alloys or compounds for products with desired physical properties. E.g. strength, weight flexibility/rigidity, resistance to hot and cold temperatures, radiation, or chemicals.

- Complex process development with the design and manufacture of specialised or bespoke tools or jigs for product manufacturing.

- Development of machining or forming processes with greater precision, on a greater scale, or using new materials.

Packaging research and development:

- Structural design of packaging to reduce weight or cost, to increase strength or resilience, or to better protect its contents.

- Increasing the shelf life of package contents through improved protection and atmospheric control.

- Enhancing or improving the print finish use of alternative inks, varnishes or substrates.

- Reduced environmental impact through alternative materials or manufacturing processes.

- Significant reduction of waste through process and machinery innovation.

- Integration of complex manufacturing processes into one fully automated process.

- Use of alternative closure methods such as magnetic closures or re-sealable packages.

Why choose Ayming?

Our team of experts can:

- We’ll optimise your claim value, having increased clients’ historic claims by as much as 6 times

- We’ll do the legwork and streamline your processes to ensure minimum impact on your team’s time and resources

- We’ll ensure that your claims are low-risk and robust, safeguarding against any enquiries from HMRC

- We have a specialist manufacturing team which understands your business to identify qualifying projects