Ansys UK Limited “Ansys” has been applying simulation solutions for more than 50 years. With over 250 solution partners and 2750 academic partners operating across the globe, Ansys is regarded as the gold-standard simulation provider. Ansys’s technological resolutions operate across diverse advanced industrial engineering sectors such as healthcare, automotive, aerospace, industrial equipment, defence, and energy.

Relationship with Ayming

Most recently, Ayming’s software specialist team worked alongside Ansys to complete their year-end 31st December 2021 claim report. Through technical conversations with the multiple technical teams of competent professionals that make up Ansys’ offerings, Ayming’s technical experts were able to assess which projects would qualify for R&D tax relief. Following this, highly detailed technical documentation was drafted to substantiate the claim being made.

Julia M Taylor FCCA, Finance Director - Northern Europe, Ansys UK Limited

What Ayming did

Ayming’s expert Tech delivery team included Ione Fox, Emrah Balci and Lauren Weiss to deliver the engagement. Ansys was on more than 100 projects in the course of the accounting period that ended 31 December 2021. The Ayming team created RAG assessments in conjunction with the Ansys competent professionals, from which almost half of the projects were identified as potentially containing qualifying R&D activities. These were scrutinised to ascertain their R&D intensity and two were chosen as examples of the nature of the work undertaken to resolve scientific and technological uncertainty, a requirement for an R&D Tax claim.

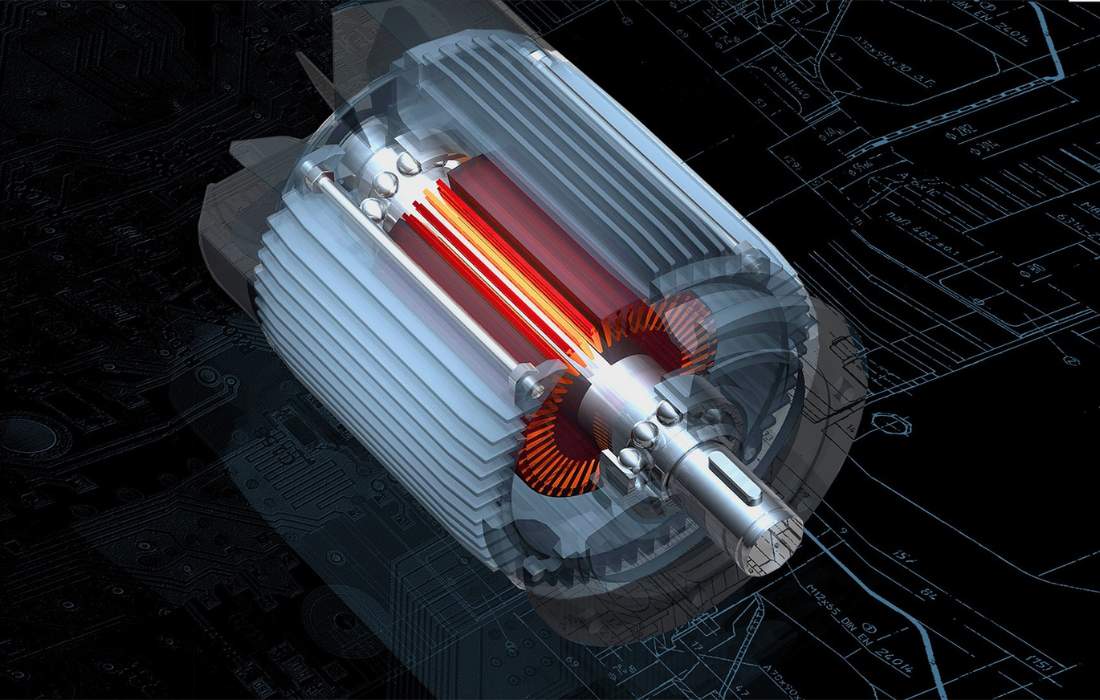

The first of these was in relation to Machine Learning for Additive Manufacturing, with Ansys seeking to create a new application. The second project example documented Material Test Data Processing which detailed the engineer’s work around advancing algorithmic logic used for processing test data and producing material properties through the development of a novel application.

The multifaceted, highly technically complex integrations that both projects required were not straightforward for the engineers to undertake. This resulted in several technological challenges being faced throughout the process. These challenges were highlighted in the report to demonstrate to HMRC the innovative, uncertain task faced by Ansys and the qualifying nature of the projects for R&D Tax purposes.

Results & Innovation

The result of the most recent claim year included a 7 figure amount in qualifying expenditure and a significant net tax benefit due to the company. The Ansys team subsequently contracted with Ayming for a further two years of claims, which the Ayming team is looking forward to optimising.