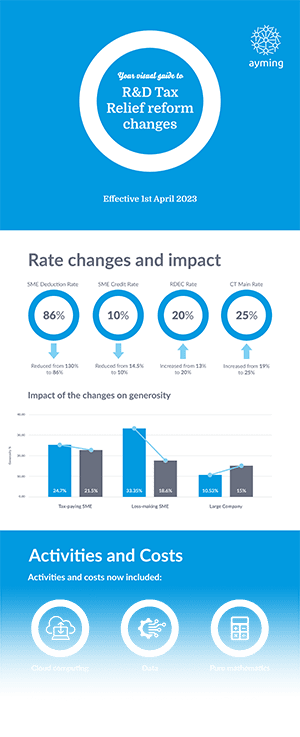

The UK government has made significant changes to the R&D tax incentive schemes. Whilst these changes were designed to make it easier and more attractive for businesses to invest in R&D, there are some potential new barriers and sticking points. Ayming’s mission is to make it as easy as possible for UK businesses to benefit from their R&D projects. So, we’ve created the infographic below, which breaks down the key changes clearly and concisely.

The infographic covers the following topics:

- Rate changes and impact

- New activities and costs

- Administrative changes

- The new required ‘Additional Information Form’

- Expected timeframes

The infographic is a valuable resource for UK businesses claiming R&D tax relief. It provides clear and concise information on the changes to the UK’s R&D tax incentive schemes and makes it easy to understand what you need to do.

To download the full infographic, click the button below:

Still need some more information? Here are some resources you might find helpful:

- Webinar: R&D tax relief scheme changes – Benjamin Craig, Associate Director: R&D Tax, talks through the recent changes and answers attendees’ questions

- Video: R&D Tax relief scheme changes – Ben breaks down the changes across four short explainer videos on our YouTube playlist

- Whitepaper: R&D Tax 101 – We’ve put together everything you need to know, whether you’ve claimed before or are new to R&D tax credits, R&D 101 is your first stop shop to everything R&D

No Comments