Investor Partnerships Scheme

Innovate UK’s Investor Partnerships Scheme is a non-dilutive grant tied to equity investment, designed to support businesses by accelerating their innovation to market. The scheme functions by combining grant funding with aligned equity investment from trusted venture capital partners.

Investor Partnerships is re-emerging with increased importance following the closure of the SMART Grants scheme in early 2025, due to oversaturation and low success rates for applicants. The revamped investor partnerships scheme now brings larger sums to businesses, in a plan to crowd in private investment in high-growth areas of the economy.

The scheme helps de-risk the journey from R&D to commercialisation by connecting businesses with both public and strategic private funding. By fostering long-term relationships between investors and cutting-edge companies, Investor Partnerships accelerates the development of transformative technologies and strengthens the UK’s innovation ecosystem.

Ayming offers end-to-end support for innovative businesses applying to the Innovate UK Investor Partnerships programme, aligning grant timing with funding rounds, shaping compelling project storylines, and managing the entire application on our client’s behalf.

Our introduction to KETS

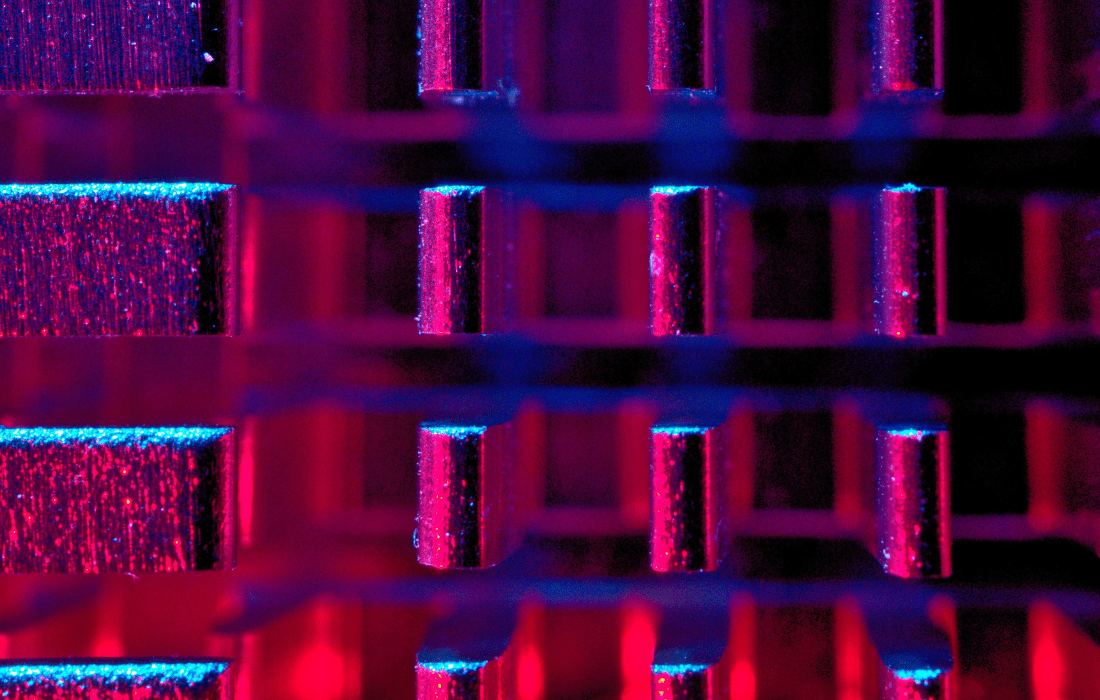

KETS Quantum Security is a UK-based deep tech company pioneering secure communications for the quantum age. From its beginnings at the University of Bristol, KETS has grown to develop chip-based quantum encryption technologies that enable ultra-secure data transmission, protecting against both current and future cyber threats – including those posed by quantum computers.

Its mission is to make quantum-safe security accessible, scalable, and commercially viable across industries such as defence, telecoms, and finance. The project that we gained support from Innovate UK’s Investor Partnerships scheme focuses on advancing their Quantum Key Distribution (QKD) technology for real-world, high-security environments — specifically targeting data centres and telecoms providers.

KETS ’ breakthrough innovation lies in developing the world’s first chip-to-chip QKD solution. This novel approach drastically reduces QKD technology’s physical footprint and energy requirements, making it viable for widespread commercial adoption. Their solution is approximately 3,000 times smaller and requires up to three times less voltage than standard fibre modulator technology’.

What Ayming did

Our services cover the full funding journey: from defining strong, strategically aligned projects that meet the scheme’s technological and commercial maturity demands, to ensuring companies demonstrate key criteria on additionality and traction that we know Innovate UK prize most.

We managed the full application process for KETS, from early ideation through to final drafting, while also guiding them through Innovate UK’s requirements. This included working with the investor to prepare key documents such as the Expression of Interest (EIF) form. Throughout, we liaised directly with the Innovate UK team to ensure the project aligned to scope and progressed smoothly through the evaluation and investment committee stages.

Our team combines deep technical expertise, with PhD-trained consultants operating from the heart of London’s financial district. We have cultivated an unparalleled network within the venture capital and investment community, giving clients access to valuable funding and partnership opportunities. Our grant writing played a key role in helping KETS Quantum Security unlock matched funding, securing both public and private investment to advance their quantum technology development — a fantastic example of the impact we deliver for our clients.

Key Achievements

Our engagement with KETS helped them secure 70% funding for their £998,676 project, resulting in a £699,073 grant from Innovate UK. This funding enables them to continue innovating and advancing their development.

At Ayming, we understand that grants are just one piece of a company’s broader financing strategy — and we ensure that our support fits seamlessly into the wider journey from innovation to commercial success. Founders trust us to take ownership of the grant funding process, freeing up their time to focus on what matters most: developing and commercialising their technology.

Beyond investment, Ayming’s global footprint — with 14 offices worldwide — offers unique links into international supply chains, helping businesses scale and validate their technologies. We also open doors to collaborations with some of the world’s leading corporates, drawing on our grant team’s existing relationships with major clients such as Morgan Sindall and Tarmac.

This comprehensive platform of support ensures that businesses we work with are not only able to secure non-dilutive funding, but are also positioned for long-term growth, engagement with high-value customers and market success.

Ayming ensures the Investor Partnerships scheme benefits all sides – from the VC funds seeking companies to invest in, to companies searching for private investment bolstered by Innovate UK’s re-emerging scheme.

Lisa Matthews, MD & COO at KETS Quantum Security