Discover our experts' thoughts, views and opinions all in one place.

Insights

Response to the UK’s Modern Industrial Strategy 2025

London, 23 June 2025: The government unveiled its Modern Industrial Strategy on the 23rd June 2025, marking a bold 10-year vision to…

More

Investor Partnerships Scheme Innovate UK’s Investor Partnerships Scheme is a non-dilutive grant tied to equity investment, designed to support businesses…

From Lab to Launch: KETS ’ growth through UK Investor Partnerships

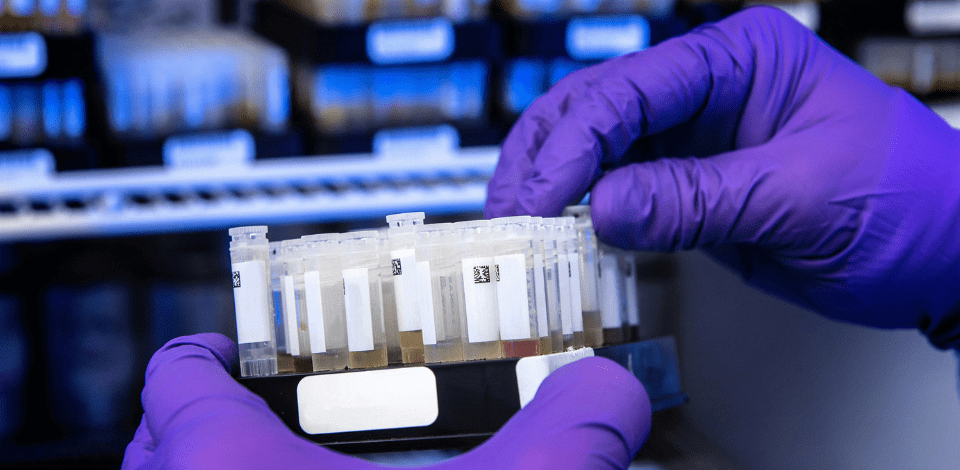

The Vision – Reinventing dairy for a more sustainable future Better Dairy is at the forefront of sustainable food innovation.…

Cream of the crop: Better Dairy ’s bold step toward sustainability

London, 31 March 2025: Following last week’s release of the highly anticipated Spring Statement 2025, we reflect on the proposals…

Response to Spring Statement 2025

With the right knowledge and support, UK businesses can unlock thousands to millions in non-dilutive funding. The 2025 edition of…

Grants 101

For businesses investing in R&D, understanding the landscape of global tax incentives is key to optimising financial benefits and driving…

The Benchmark 2025

Securing public funding—whether for R&D, capital expenditure, or sustainability projects—can be a game-changer for your business. Grants provide the financial…

Mastering Grant Applications: The Six Pillars of Success

ERM x Ayming Joint Webinar: Building a Green Solvents Consortium for Sustainable Medicine Manufacturing

ERM and Ayming are leading the way in sustainable innovation, bringing together key stakeholders to form a supply-chain consortium for…

More

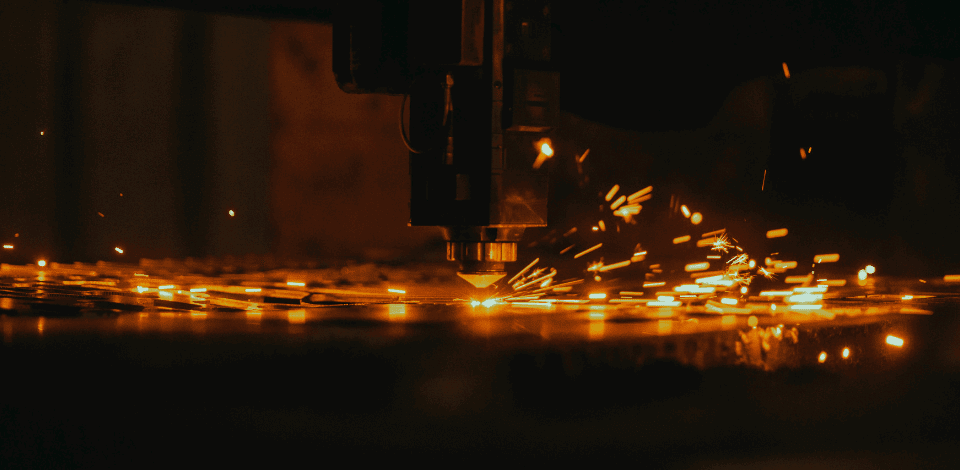

We all know how important R&D tax credits are for the Life Sciences, Pharmaceuticals, and Biotech sectors. Most companies in…

Life Sciences sector may be underclaiming R&D tax credits

Securing the right funding is critical for founders looking to fuel innovation, extend cash runway, and strengthen market positioning. The…

Founder’s Guide to Innovation Funding

Environmental, Social, and Governance (ESG) priorities have shifted from an emerging trend to a business imperative. Companies worldwide are facing…

International ESG Barometer 2025

The Investor’s Guide to Innovation Funding offers unparalleled insights into leveraging innovation funding to maximise portfolio value. From R&D tax…

Investor’s Guide to Innovation Funding

London, 29 January 2025: Innovate UK recently announced the ending of its Smart Grant scheme. However, it is currently working…

Innovate UK pauses Smart Grants programme

London, 24 January 2025: Ayming and ERM have been awarded Innovate UK funding as part of the Sustainable Medicines Manufacturing…

Ayming and ERM to build a supply chain consortium for green solvent manufacturing for pharmaceuticals