Manufacturer of complex composite and metallic components

Founded in 1972

Revenue: £10.78m (2021)

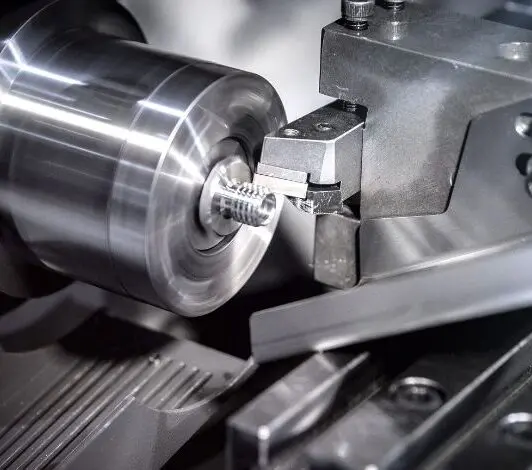

The Retrac Group is an established medium-sized employee-owned manufacturing company, with specialist expertise in manufacture of composites and composite tooling, as well as precision machining of metals and plastics.

Retrac is a trusted supplier to some of the largest brands in the Automotive, Aerospace, Formula One™ and Motorsport sectors. The company is well-known for its ability to manufacture extremely challenging parts and its use of novel materials.

Retrac and Ayming’s partnership

Retrac first started working with Ayming on its R&D Tax claims in 2016, looking back to their 2014/15 financial year claim. Seven years later, Ayming continues to partner with Retrac. Until working with Ayming, Retrac had not claimed for their innovation projects through the HMRC scheme.

Retrac is a fast-paced business with fast-paced customers. Working with Ayming removes the distraction from the R&D claim process, allows us to focus on our customers and projects. Rob & Duncan have a deep understanding of our business, and a thorough understanding of engineering R&D. This has meant that working with them we have been able to deliver our best result to date for our R&D Tax claim, despite the challenges we faced while innovating during the height of the Covid pandemic. I look forward to working with Ayming on next year’s projects.Dan Walmsley, CEO Retrac Group

Ayming’s expert team

Ayming’s Rob Miles and Duncan Kelly, R&D Senior Manager and Senior Consultant respectively, worked with Retrac on their latest claim. Rob, a chartered engineer, has a number of years’ experience delivering R&D Tax claims for clients in the manufacturing sector. Duncan worked in R&D for a 3D-printing manufacturer before joining Ayming and had previously worked with several of Retrac’s customers.

Their combined engineering experience and expertise meant they were well-placed to fully understand the qualifying projects involved in the claim and work peer-to-peer with Retrac’s technical team to uncover all the qualifying R&D expenditure.

How did Ayming work with Retrac?

Having worked with Retrac over a number of years to deliver their R&D Tax claim, the methodology and claim process is well-developed. Even so, Rob and Duncan were delighted to be able to deliver the best result yet for Retrac, despite them having had a lower turnover in a ‘COVID’ year.

Innovation and results

Several qualifying projects were included in the claim, including the development of a method of manufacturing a very thin glass-fibre reinforced PEEK part, for use in electrical aircraft engines.

Retrac had also carried out a study into the machining behaviour of carbon-filled PEEK for use in a Formula One power unit, which was eligible for the claim. The final qualifying expenditure for the claim amounted to almost 11% of Retrac’s turnover for the ‘20/’21 financial year.

Our client

- Manufacturer of complex composite and metallic components

- Founded in 1972

- Revenue: £10.78m (2021)